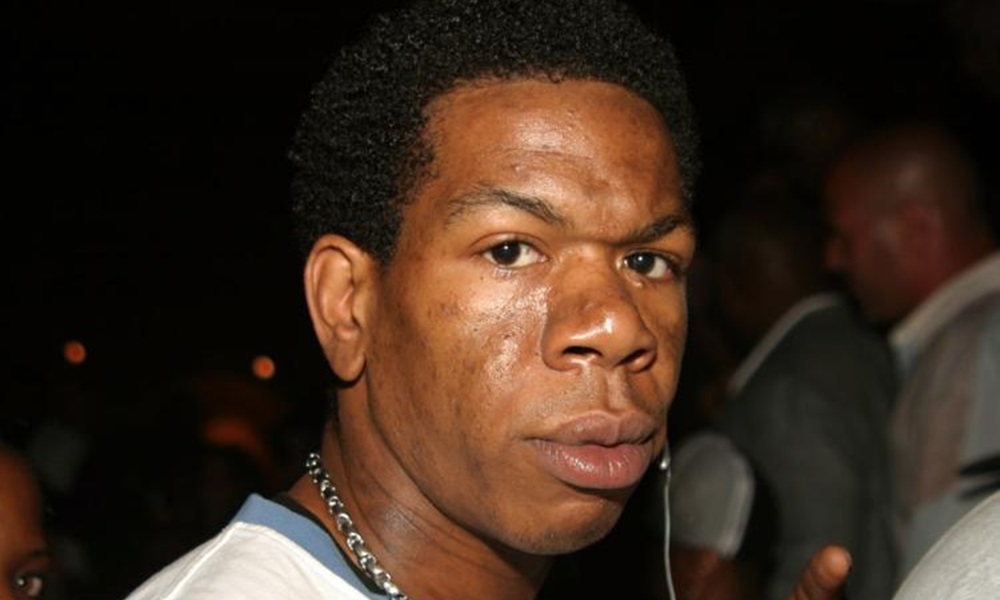

Ye, formerly known as Kanye West, is back in the billionaires club with a net worth of $2.77 billion as of 2025. His extensive music catalog and sole ownership of the Yeezy brand fueled this impressive financial resurgence.

Ye celebrated on Instagram, referencing his 2007 hit “Can’t Tell Me Nothing,” captioning, “LAA LA LA LA.” The shared image states, “In 2025, Ye’s net worth stands at $2.77 billion USD, as confirmed by Eton Venture Services. The valuation is based on his music portfolio and his sole ownership of the Yeezy mark.”

The controversial rapper and entrepreneur also recently bragged about generating $100 million in Yeezy Pod sales within six months, proving his enduring influence.

Want to achieve Ye-level success? Master these 7 essential money rules ASAP:

1. Live within your means. Spend less than you earn to reduce financial stress, build savings, and avoid debt. Research shows people who live below their means are generally happier. Delay gratification on unnecessary splurges.

2. Start saving for retirement early. Take advantage of compound interest by beginning to invest in your 20s if possible. Someone who starts at 25 could have twice as much by retirement as someone starting at 35, due to more time to grow money.

3. Build an emergency fund covering 3-6 months of expenses. This savings cushion protects against job loss, medical emergencies, and unexpected costs – providing crucial peace of mind. Keep in a separate, easily accessible account.

4. Avoid consumer debt like credit cards and car loans. High-interest debt decimates wealth-building and even damages health like smoking, studies show. Pay off balances monthly and live debt-free when possible.

5. Create passive income streams through real estate rentals, dividend stocks, royalties, and online businesses. Earn money while you sleep to reach financial independence faster. Reinvest gains back into income-generating assets.

6. Develop a realistic monthly budget tracking all income and expenses. Identify areas to cut back and prioritize important goals like saving and investing. Use budgeting apps or spreadsheets to stay organized.

7. Invest money consistently into diversified, low-cost index funds. Historically, investing in stocks provides the best returns over long timeframes. However, bonds, real estate, and international exposure should also be considered. Automate investments and start early.

Follow in Ye’s financially-savvy footsteps and abide by these 7 money commandments. Build smart habits now to secure and grow wealth well into the future. Stay focused, disciplined, and unwaveringly optimistic about what’s possible.